sustainability

authentic

measure

Turn mandated climate reporting into a 12-month growth engine.

How compliance in climate and sustainability will unlock value, opportunities and resilience for your company.

Climate and sustainability reporting has now landed firmly on the CFO’s desk with International Sustainability Standards (ISSB).

It’s a whole of business challenge and time to tackle 4 global headwinds.

Climate change is one of the defining challenges of this decade.

The action that companies take now will shape their resilience framework ensuring relevance into the next horizon.

“58% of Asia-Pacific finance leaders say their industry’s sustainability reports are at high risk of being viewed as ‘greenwashing’ because the underlying data can’t be fully trusted.”

EY Corporate Reporting Survey 2024

Authentic Sustainability Measure

FutureValue has built its Authentic Sustainability Measure (ASM) specifically for CFOs, Boards and C-suite leaders to enable companies to:

Deliver on regulatory demands

Leverage strategic advantage

Go beyond Net Zero

We recognise that climate and sustainability benefits and impacts are fast becoming the differentiator when it comes to competitive advantage.

How It Works

Our four-step approach:

1

Review source documents, create goverance pathway to embed & operationalise climate.

Baseline Assessment report with key risk & impact indicators & draft climate scenarios.

2

3

Commence emmissions reporting, build capability through the CFO & support ISSB reporting.

4

Build the business case for investment, identify company objectives & unlock strategic advantage.

Why Act Now

Global jurisdictional accounting standards are mandating companies to act. The Australian Sustainability Reporting Standards (ASRS) have become law with a three-year phased in approach.

Global regulations impact every company, irrespective of size, complexity or sector.

Scrutiny from all stakeholders, regulators, supply chains, customers and financial institutions will demand real action.

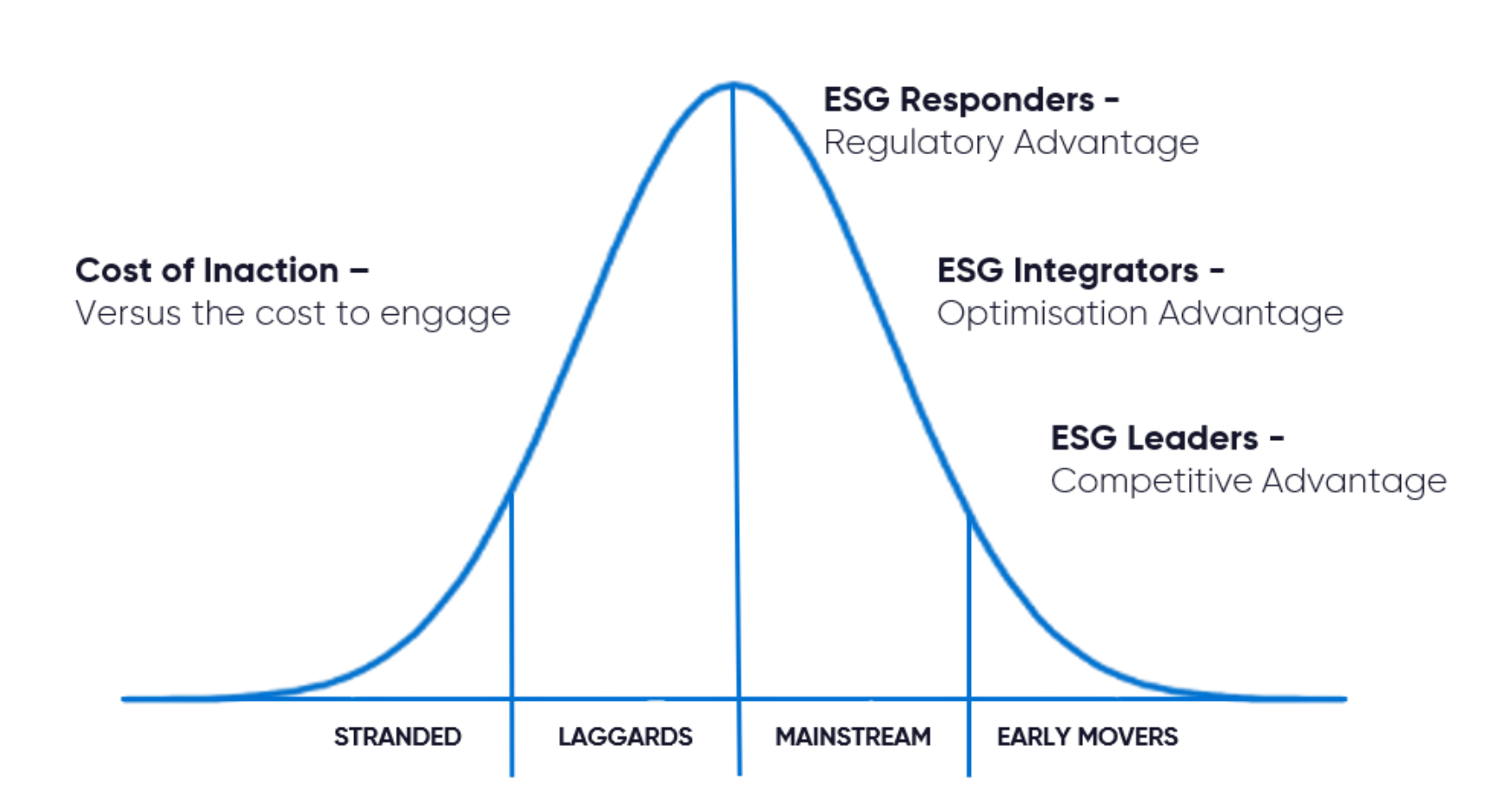

“The cost of inaction outweighs the cost of action: models show that failing to act on climate could wipe US $178 trillion from global GDP between 2021-2070, whereas a rapid net-zero transition would add US $43 trillion – a swing of more than US $220 trillion, or roughly 4-to-1 in favour of action”

Deloitte Economics Institute – “Turning Point” (2022)

Why ASM

Founded by FutureValue, Authentic Sustainability Measure is the combination of bringing impact, regulation and regeneration into one model.

Our ability to balance impact and compliance ensures that regulation is the first step towards regeneration which results in a win for business, the community, and the environment.

Benefits of using ASM

We Can Help

FutureValue understands sustainability. It is about getting beyond impact to ensure we create the right conditions for regeneration: socially, environmentally, and economically.

Mandated reporting isn’t just a compliance headache; it can unlock value, opportunities and resilience for your company.

Talk to us now about operationalising your sustainability needs.

“Being a CFO in key financial leadership roles for the past 25+years, I understand the need for compliance whilst ensuring commercial viability.

The ASM approach enables transformation across the whole organisational system. Embedding climate and sustainability into our operating systems and decision-making means everything needs a refresh, including our spreadsheets.”

Paula Kensington, FutureValue,

Director, Group Finance & Beyond Sustainability